In the United States, as in most parts of the world, we saw something of a catch-up effect in 2018. But behind the scenes, the fundamentals of the American market are in turmoil, as a result of the growth of the smartwatch, the concentration of retail in European hands and the strong growth of the secondary market, thanks to the internet.

First upheaval: the breakthrough of the smartwatch

You can do a test, in a New York restaurant or at a Los Angeles gym, by looking at the wrists of the other people there. There is no doubt that the Apple Watch will be in the majority – and this includes women. Even more so than in Europe, the smartwatch has established itself in the under-$500 watch segment in the United States. It is one of the major upheavals to have occurred in North America since 2015.

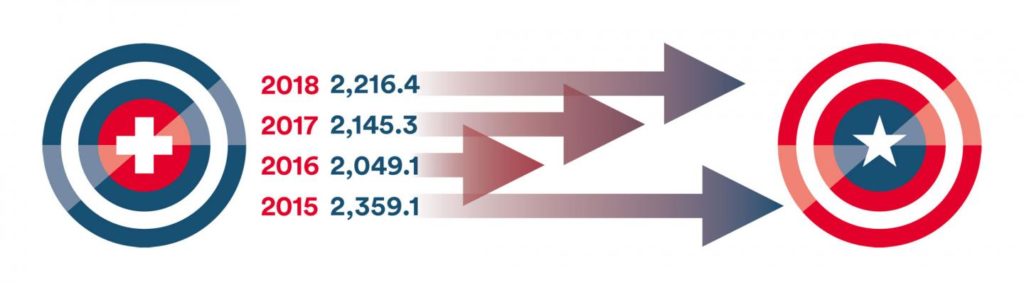

However, it doesn’t seem to have impacted the traditional luxury mechanical watch market. On the contrary, “fine mechanics” were on the road to recovery in 2018, a catching-up effect observed in both the US and in Asia. With more than 2.2 billion francs of Swiss watch exports to the United States last year, the market grew by 8% and is approaching the results of 2015. To sum up, one could say that the “volume” market seems to be gradually moving towards Apple, while “value” remains firmly anchored among the traditional Swiss brands.

Is there any room left for the American fashion watch giants such as Fossil Group, Movado Group and Timex in this scenario? Since its acquisition of Misfit in 2015, Fossil Group has resolutely opted for the switch to connection, launching “smart” models of Fossil, Armani, Diesel and Michael Kors watches quarter after quarter. The erosion of its stock market share illustrates the group’s difficulties in the face of Apple’s arrival on its playing field. Nevertheless, the sale in January 2019 of $40 million worth of connection technologies to Google reassured investors and could signal the beginning of a trend reversal.

Kosta Kartsotis, Chairman and CEO of the Fossil Group, stated last November: “While the business continues to face topline headwinds stemming from declines in the traditional watch category, combined with business exits and closings of underperforming stores, we are focused on narrowing the gap with gains in connected and digital sales.”

Second upheaval: European retailers arrive in force

A second major upheaval in the United States is the evolution of retail structures. As everywhere in the world, a significant proportion of brands intend to combine opening their own stores with controlling online sales to lock their distribution. The most recent cases are those of Richard Mille and Audemars Piguet, which both left the SIHH trade show at the same time. The recent opening of a Richard Mille boutique in New York – the largest in the world – also marks the opening of a new era. Audemars Piguet, meanwhile, intends to abandon distribution in multi-brand outlets within three and a half years, according to its CEO François-Henry Bennahmias.

In the United States, there have been many closures of traditional small to medium-sized shops. We also see a growing concentration of distribution in a handful of powerful European chains that remain very close to their bestselling brands, such as Rolex, a dominant brand in the United States. We have observed the takeover of the Tourneau chain by the Swiss retail giant Bucherer, and that of the Mayors chain by British retailer Watches of Switzerland. As for Germany’s leading retailer, Wempe, it is firmly established in New York with a store on Fifth Avenue, as well as a space that the retailer operates for Rolex. All are attracted by the promise of a market that could grow in absolute numbers.

Third upheaval: e-commerce favours second-hand watches

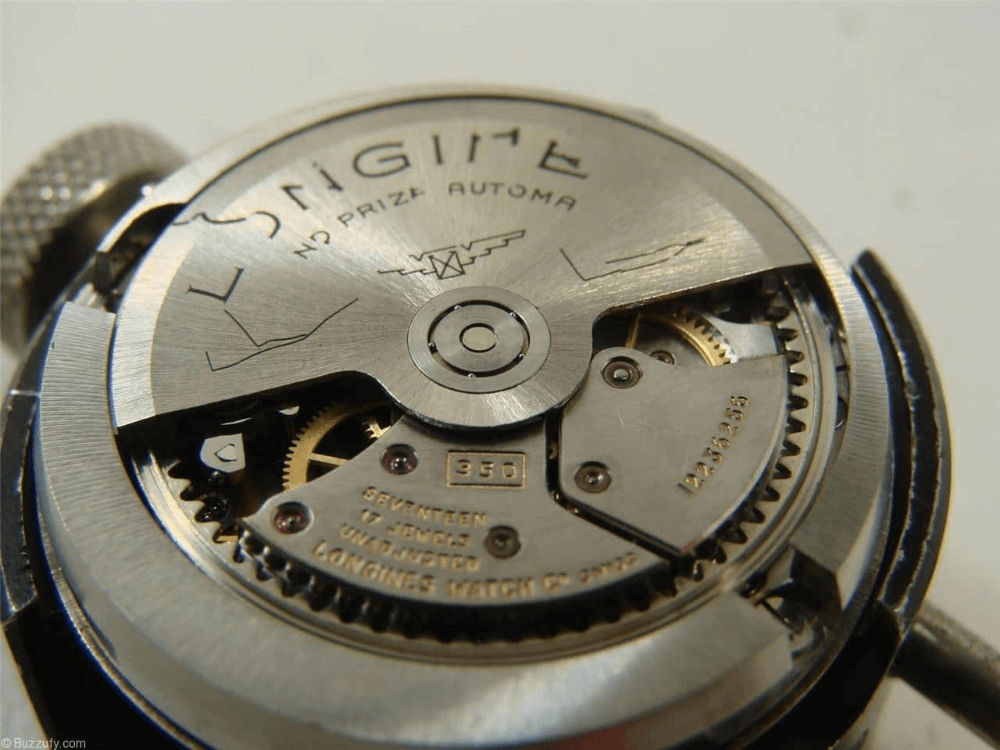

Would the emergence of the internet encourage online sales of smartwatches? Or of ultra-contemporary models? Neither, in fact. The first segment to benefit from the arrival of e-commerce has been the so-called “grandfather’s watch”, second- or even third-hand, on a market that is still often greyish, fuelled by genuine vintage timepieces, but also by the effects of an overproduction of watches, via so-called pre-owned models, in reality often “never-worn”, at fire-sale prices.

The online watch sales landscape remains something of a jungle, but clearings are starting to appear. In this respect the United States, the cradle of digital technology, is acting as a pioneer, but it needs to be closely monitored. Beyond Amazon or eBay, major players specialising in the sale of second-hand luxury watches have set up shop. WatchBox has just opened an office in Switzerland (read our article here), and there’s also True Facet.

The latest step is to bring the online secondary market closer to authorised retailers and brands. WatchBox has set up a partnership with Californian retailer Hing Wa Lee, and its arrival in Switzerland is also related to its desire to offer brands a direct channel to the secondary market. The historic American retailer London Jewelers has established a partnership with the pre-owned platform Crown & Caliber. Having just raised $10 million in venture capital, True Facet is working with Silicon Valley retailer Stephen Silver, and also directly with brands such as Raymond Weil and Fendi.